‘Cycle of community decline:’ Jacksonville zombie homes could resurge as foreclosures increase

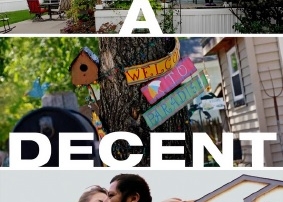

Abandoned homes, sometimes called “zombies”, are infecting local neighborhoods. During the housing recession of 2008, many homes got stuck in foreclosure limbo. In Florida the process can take years and impact surrounding property value if the houses sit abandoned for long. Early forecasts show zombies could come back to life in Jacksonville. North of downtown Jacksonville, Jeanette Williams has seen the problem firsthand. She’s not worried about her house, but the one a few doors down. “It’s been sitting there a long time. It’s been sitting there since I moved in,” Williams said. She was outside with her grandkids on an April afternoon. “That’s what I worry about — them.”